However, it may be appropriate to charge these costs directly to a sponsored project when the participation of the administrative/clerical staff being charged to a federal project meet all four of the following conditions as set forth in §200.413 of the Uniform Guidance: The salaries of administrative and clerical support staff normally should be treated as indirect costs. Direct charging of these costs may be accomplished by specifying individual positions within the project budget or through the use of recharge rates or specialized service facilities, as appropriate under the circumstances. For example, salaries of technical staff should be treated as direct costs wherever the work to be undertaken can be identified with a particular sponsored project. Technical staffĬosts incurred for the same purpose in like circumstances must be treated consistently. The National Science Foundation, for example, usually will not pay for more than two months of summer research at a rate of one-ninth of the AY salary per month. Some sponsors, however, impose specific limitations on summer salaries. A maximum of two and one-half months may be included for the whole summer. Summer salary for faculty with academic year (AY) appointments can be figured at one-ninth of their institutional base salary for each month of summer effort. If a faculty member is working on several sponsored projects, care must be exercised to ensure that no more than 100 percent of effort is committed to the aggregate of all projects and other University responsibilities. While standard percentages are applied to make these calculations, no commitment and no constraint on the rate of increase for a given individual is implied by this procedure. An appropriate escalation rate (e.g., 3%) should be used to determine salary requirements beyond the current fiscal year. Total salary costs can be determined by applying the percentage of effort to the current salary rates. The number of person months or percent effort to be applied to the project should also be shown. The salary category in the proposed budget should include the names and/or titles for all personnel involved in the project. All budget entries should be rounded to the nearest whole dollar. A budget summary should be included for proposals with multi-year funding. If cost-sharing is included, each budget period should include columns for both "Sponsor" and "University" costs. A "starting date" should be specified, since it is essential to ensure accurate budget calculations. The budget should be subdivided into periods of 12-month duration (unless partial year funding is anticipated). Be sure to check with your department, unit, school or college administrator to determine the best practice. The format shown on the sample budget page may be used, however, if one is not specified by the sponsor. Sponsors often prescribe the budget format that must accompany the proposal, including the specific cost categories that should be identified. U-M Navigate Webinar - NIH Data Management & Sharing Policy (Nov 1, 2022).

Please note this upcoming change is currently NOT reflected in NIH's FAQs and resources on budgeting and costs under section F.

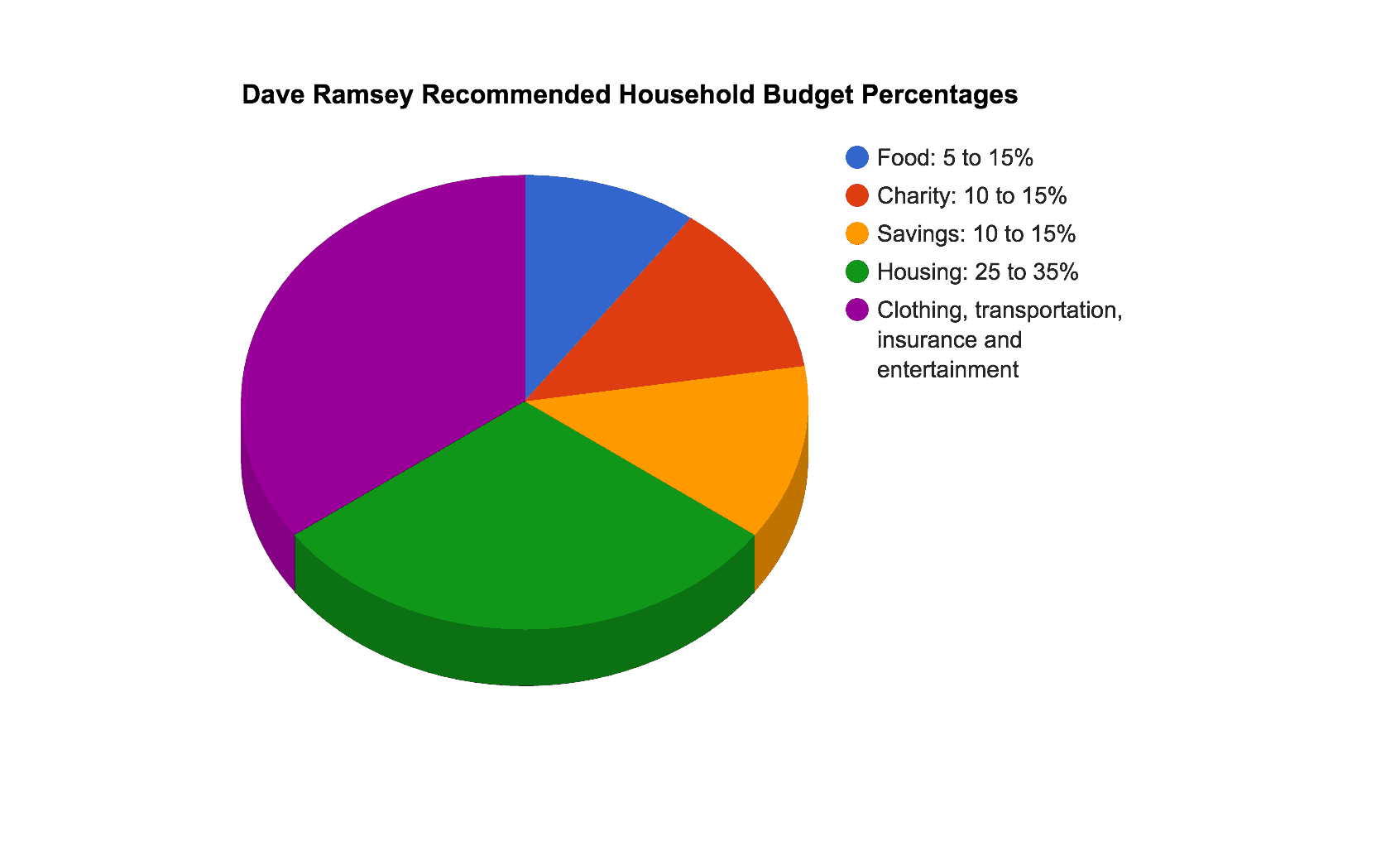

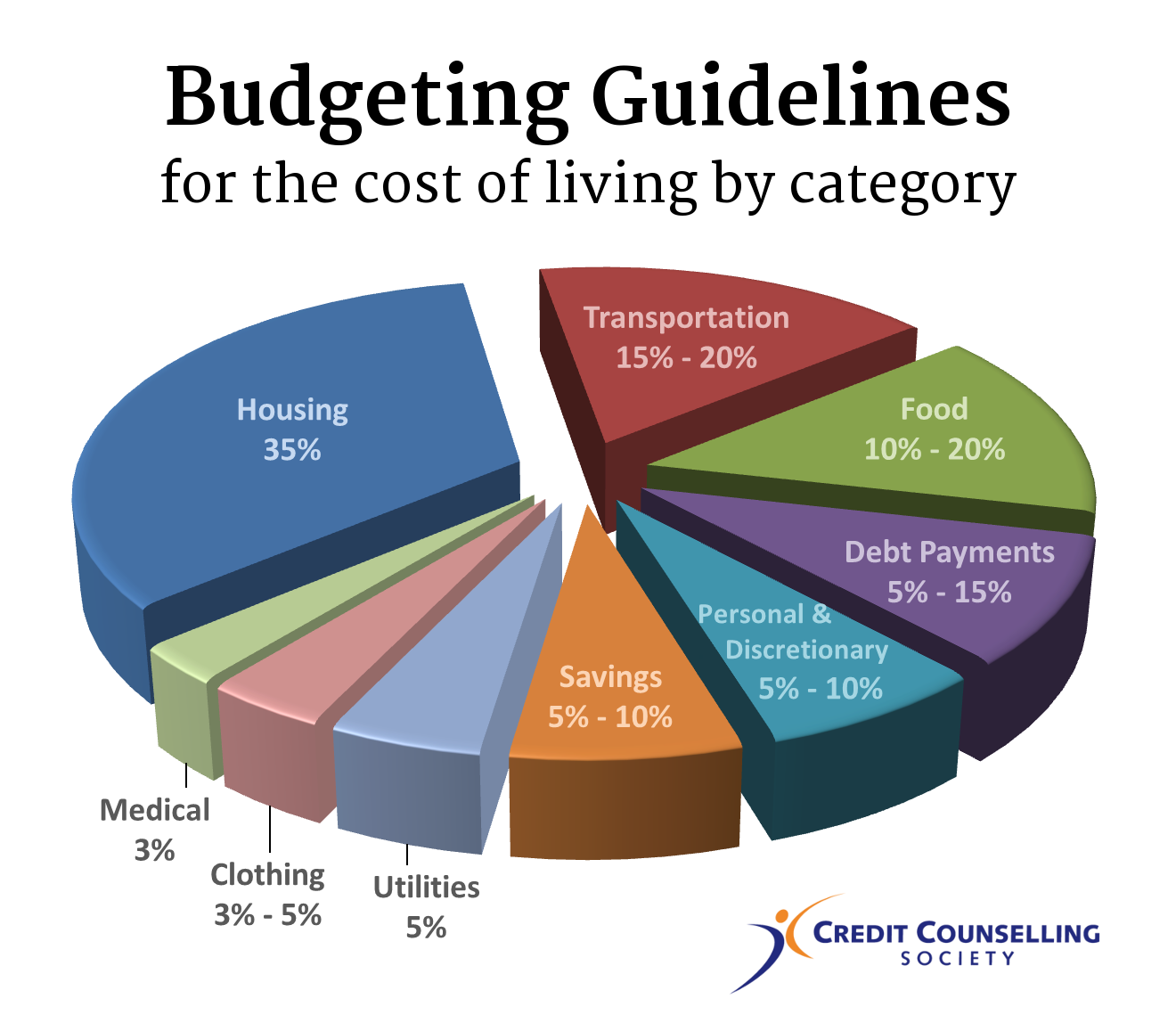

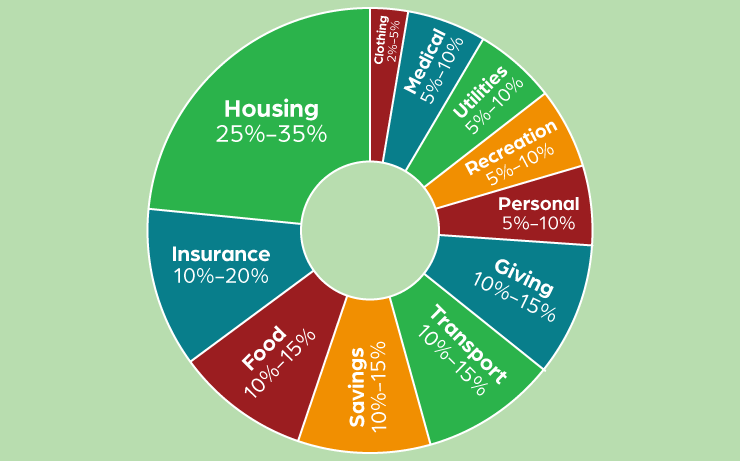

Budget percentages for single person full#

See full details in Notice NOT-OD-23-161. Instead, consistent with standard budget instructions, DMS costs must be requested in the appropriate cost category, e.g., personnel, equipment, supplies, and other expenses, following the instructions and providing details as instructed within the applicable form (e.g., R&R Budget Form or PHS 398 Modular Budget Form). New (): For submissions with due dates on or after October 5, 2023, NIH will no longer require Data Management and Sharing (DMS) costs to be shared in a single line item. the National Institutes of Health) are increasingly allowing data sharing costs to be included as direct costs in proposal budgets. A Special Note About NIH Grant-Related Data Sharing CostsĬertain funding agencies (e.g.

0 kommentar(er)

0 kommentar(er)